Fixed vs Variable Costs: The Ultimate Guide for Businesses

Introduction: Why Understanding Costs Matters

Every business decision—from setting prices to scaling operations—relies heavily on effective cost management. Yet, many entrepreneurs struggle to grasp one of its most fundamental concepts: the difference between fixed vs variable costs. In this blog, Spyglass Accounting and Financial Services breaks down these cost types to help you make smarter, more informed financial decisions.

In 2025, with economic fluctuations and rising operational expenses, knowing the difference between fixed and variable costs isn’t just accounting jargon—it’s a strategic necessity.

This guide will break down:

✔ What fixed and variable costs are

✔ Real-world examples for businesses

✔ How to calculate and manage them

✔ Impact on pricing, profitability, and cash flow

✔ Strategies to optimize both cost types

By the end, you’ll have a clear framework to analyze expenses, improve financial health, and make data-driven decisions.

Fixed vs Variable Costs: Key Differences

Definition & Comparison

| Cost Type | Definition | Changes With Production? | Examples |

| Fixed Costs | Expenses that remain constant regardless of output | ❌ No | Rent, salaries, insurance, loan payments |

| Variable Costs | Expenses that fluctuate with production/sales | ✅ Yes | Raw materials, utilities, commissions |

Key Insight:

- Fixed costs = Stability (predictable but inflexible)

- Variable costs = Flexibility (scale with business activity)

Visual Breakdown: Cost Behavior

Fixed Costs Graph

Cost ($) |___________________ Production Volume →

No change with output

Variable Costs Graph

Cost ($)

/

/

/

Production Volume →

Rises with production

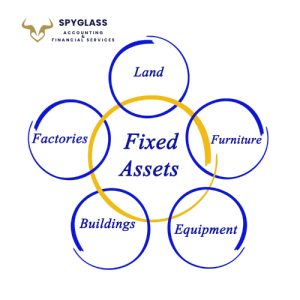

Fixed Costs: Deep Dive

What Counts as a Fixed Cost?

- Rent/Lease Payments (e.g., $3,000/month for office space)

- Salaries (Fixed wages for full-time employees)

- Insurance Premiums (Annual or monthly payments)

- Depreciation (Equipment losing value over time)

- Loan Payments (Fixed monthly installments)

Pros & Cons

✅ Predictable budgeting

✅ Easier financial planning

❌ Hard to reduce short-term

❌ Can strain cash flow in slow seasons

Real-World Example

A bakery pays $2,500/month in rent. Whether it sells 100 or 1,000 cakes, the rent stays the same.

Variable Costs: Deep Dive

What Counts as a Variable Cost?

- Raw Materials (Flour for a bakery, fabric for a clothing brand)

- Production Labor (Hourly wages for factory workers)

- Utilities (Electricity, water usage)

- Shipping/Packaging (Costs per unit shipped)

- Sales Commissions (5% of each sale paid to reps)

Pros & Cons

✅ Adjusts with business activity

✅ Lower risk during downturns

❌ Harder to predict

❌ Can erode margins if prices spike

Real-World Example

A T-shirt business spends $5/shirt on cotton. If it makes 500 shirts, variable costs = $2,500. If production doubles to 1,000 shirts, costs rise to $5,000.

Semi-Variable Costs: The Hybrid Category

Some costs have both fixed and variable components:

| Example | Fixed Portion | Variable Portion |

| Electricity Bill | Base connection fee | Usage charges |

| Sales Team Pay | Base salary | Performance bonuses |

| Internet Service | Monthly fee | Overage data charges |

Why It Matters:

- Requires more nuanced budgeting

- Often overlooked in financial planning

How to Calculate Fixed vs Variable Costs

Step 1: List All Expenses

Categorize each cost as:

- Fixed (Stays the same)

- Variable (Changes with output)

- Semi-Variable (Mixed)

Step 2: Use the High-Low Method

A simple way to separate fixed vs. variable costs:

- Identify highest and lowest production months

- E.g., January (High: 10,000 units)

- E.g., August (Low: 2,000 units)

- Note total costs for both months

- January: $50,000

- August: $20,000

- Calculate variable cost per unit:

(Total Cost High – Total Cost Low) / (Units High – Units Low)

($50,000 – $20,000) / (10,000 – 2,000) = $3.75/unit

4. Solve for fixed costs:

Total Cost – (Variable Cost × Units) = Fixed Cost

$50,000 – ($3.75 × 10,000) = $12,500

Result:

- Variable Cost = $3.75/unit

- Fixed Cost = $12,500/month

Impact on Pricing & Profitability

Break-Even Analysis

Formula:

Break-Even Point (Units) = Fixed Costs / (Price per Unit – Variable Cost per Unit)

Example:

- Fixed Costs = $12,000/month

- Price per Unit = $25

- Variable Cost = $10

$12,000 / ($25 – $10) = 800 units

You must sell 800 units/month to cover costs.

Margin Management

- High Fixed Costs? → Need higher sales volume to profit.

- High Variable Costs? → Price hikes directly impact margins.

Cost Optimization Strategies

For Fixed Costs:

- Renegotiate leases (e.g., remote work reduces office space needs)

- Outsource non-core functions (e.g., HR, IT)

- Refinance debt to lower interest payments

For Variable Costs:

- Bulk purchasing discounts (e.g., raw materials)

- Automate production to reduce labor costs

- Energy-efficient upgrades to lower utilities

For Semi-Variable Costs:

- Cap usage (e.g., data plans for internet)

- Hybrid workforce models (Balances office and remote costs)

Common Mistakes to Avoid

❌ Ignoring semi-variable costs (They distort budgets)

❌ Underestimating variable cost inflation (Supply chain shocks happen)

❌ Overcommitting to fixed costs (Rigidity hurts during downturns)

Tools to Track & Manage Costs

| Tool | Best For |

| QuickBooks/Xero | Categorizing fixed vs. variable expenses |

| LivePlan | Forecasting cost scenarios |

| Fyle | Tracking real-time spending |

Pro Tip: Spyglass Accounting offers custom cost analysis to optimize your expense structure.

Conclusion: Mastering Cost Management in 2025

Understanding fixed vs. variable costs empowers you to:

✔ Price products profitably

✔ Plan for growth sustainably

✔ Navigate economic shifts confidently

Need help? Spyglass Accounting specializes in small business cost optimization. Book a free consultation today!